Jim Zarroli

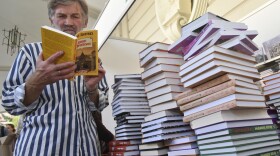

Jim Zarroli is an NPR correspondent based in New York. He covers economics and business news.

Over the years, he has reported on recessions and booms, crashes and rallies, and a long string of tax dodgers, insider traders, and Ponzi schemers. Most recently, he has focused on trade and the job market. He also worked as part of a team covering President Trump's business interests.

Before moving into his current role, Zarroli served as a New York-based general assignment reporter for NPR News. While in this position, he reported from the United Nations and was also involved in NPR's coverage of Hurricane Katrina, the London transit bombings, and the Fukushima earthquake.

Before joining NPR in 1996, Zarroli worked for the Pittsburgh Press and wrote for various print publications.

He lives in Manhattan, loves to read, and is a devoted (but not at all fast) runner.

Zarroli grew up in Wilmington, Delaware, in a family of six kids and graduated from Pennsylvania State University.

-

As local elected officials continue to face pressure to pass resolutions calling for an end to the fighting in Gaza, some aren't sure how or whether to take a stand at all.

-

Posting a torrent of fake negative book reviews — sometimes before a book is out or has even been written — is a known problem on the literary social media site.

-

NPR revisits the Borscht Belt, a place where Jewish families from New York escaped for the summer at a time when they weren't welcomed elsewhere.

-

NPR revisits the Borscht Belt, a place where Jewish families from New York escaped for the summer at a time when they weren't welcomed elsewhere.

-

The late author Joan Didion was an exemplar of the New Journalism of the 1960s. Many fans traveled to Hudson, N.Y., to see some of her possessions up for auction. A pair of sunglass fetched $27,000.

-

When the author was attacked earlier this month, he was taking the stage at New York's Chautauqua Institution. The storied place in American cultural life is now rethinking how open it should be.

-

For dissident writers fleeing persecution overseas, the United States has long been a safe haven, a place where freedom of expression is tolerated and, even, valued.

-

Goats are taking over Manhattan. Or, at least a sliver that needs serious weeding. It's happened the past few summers and has become a beloved ritual for those unused to interacting with farm animals.

-

At a time of concern about book banning, states are passing laws to tighten control over public libraries. The laws address how libraries are managed and some laws may open librarians to legal action.

-

After the Crimea invasion, a backlash against Russian books filled with propaganda led to the growth of Ukraine's own book industry. But Russia's latest attacks and Covid have created major obstacles.